(Petrobras, 1.Feb.2019) — Following the Material Facts disclosed on December 26 and 28, 2018 and January 8, 2019, Petrobras informs that the bookbuilding of the sixth (6th) issuance of simple, non-convertible, unsecured debentures of the Company (“Issuing” and “Debentures”), for placement under best efforts, pursuant to CVM Instruction 400 of December 29, 2003 (“CVM Instruction 400”), considering the procedure indicated for issuers with large exposure to the market, in accordance with Articles 6-A and 6-B of said instruction (“Offer”), resulted in a total value of three billion and six hundred million reais (R$ 3,600,000,000.00).

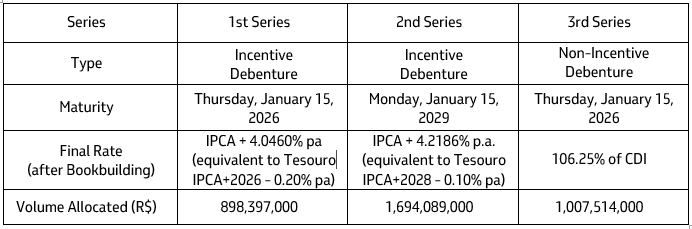

The table below shows a summary including the final conditions obtained and the allocation of Debentures across the series of the Issuing:

The Offer will start only after (i) the fulfillment of the requirements set forth in the Offer documents; (ii) the granting of registration of the Offer by CVM; (iii) the deposit of the Debentures with B3 S.A. – Brasil, Bolsa, Balcão e/ou B3 – Segment CETIP UTVM for distribution and trading; (iv) disclosure of the notice of commencement; and (v) the definitive prospectus made available to investors, pursuant to CVM Instruction 400.

The final settlement of the transaction is scheduled for February 12, 2019, in accordance with the schedule set forth in the Offer documents.

This market communication is for information purposes only, in accordance with the legislation in force, and should not be interpreted or considered, for all legal purposes and effects, as a material for the sale and/or disclosure of the Debentures and/or the Offer.

***