(GeoPark, 5.Feb.2019) — GeoPark Limited announced its independent oil and gas reserves assessment, certified by DeGolyer and MacNaughton Corp. (D&M), under PRMS methodology, as of December 31, 2018.

All figures are expressed in US Dollars.

Year-End 2018 D&M Certified Oil and Gas Reserves and Highlights:

— Higher Per Share Value:

After consolidated capital expenditures of $2.9 per share in 2018:

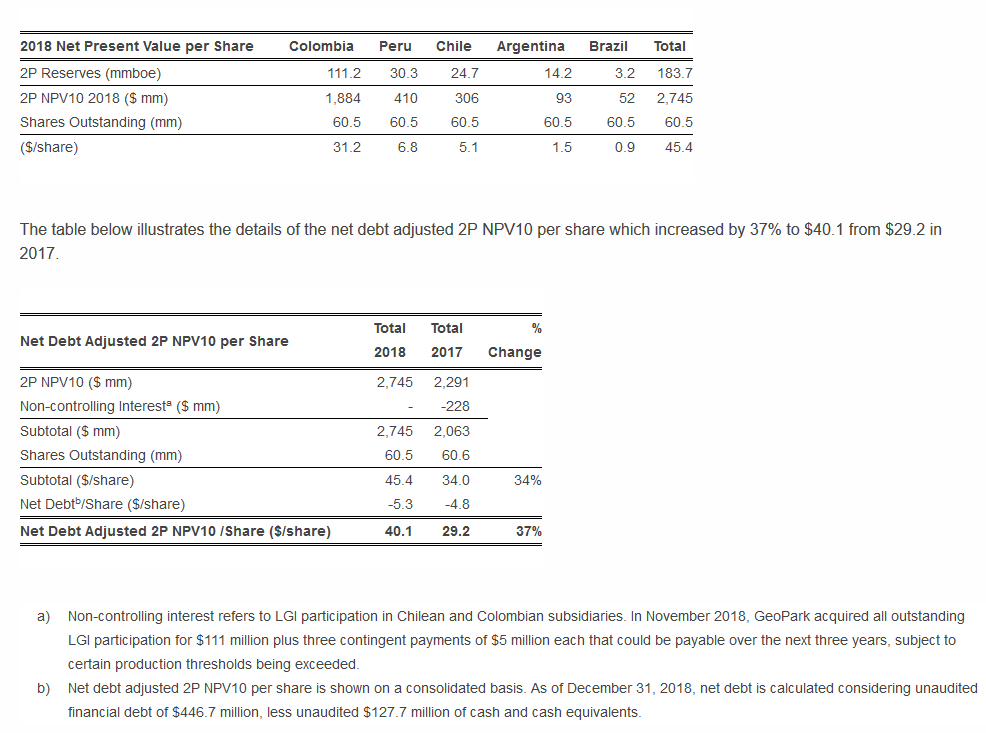

— Net debt-adjusted 2P NPV10 increase of $10.9 per share (3.8 times higher) to $40.1 per share, from $29.2 per share in 2017

— Significant increase in Colombia’s net debt adjusted 2P NPV10 by 64% to $25.9 per share, from $15.8 per share in 2017, with capital expenditures of $1.6 per share

— Accretive acquisition of LGI’s equity interest in GeoPark’s Colombian and Chilean subsidiaries for $2 per share, with a 2018 estimated 2P NPV10 of $4 per share

— PDP Reserves:

– Net proven developed producing (“PDP”) reserves increased 55% (by 15.7 mmboe) to 44.2 mmboe

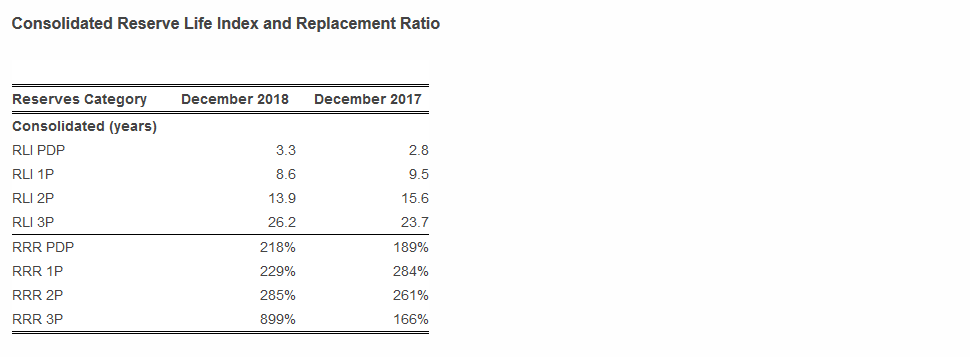

– PDP reserve life index (“RLI”) of 3.3 years

– PDP reserve replacement ratio (“RRR”) of 218%

— 1P Reserves:

– Net proven (“1P”) reserves increased 17% (by 16.9 mmboe) to 113.9 mmboe

– 1P RLI of 8.6 years

– 1P RRR of 229%

– 1P NPV10 increased by $268 million (up 17%) to $1.8 billion

— 2P Reserves:

– Net proven and probable (“2P”) reserves increased 15% (by 24.5 mmboe) to 183.7 mmboe

– 2P RLI of 13.9 years

– 2P RRR of 285%

– 2P NPV10 increased by $454 million (up 20%) to $2.7 billion

— Colombia 2P and 3P Reserves:

– Net 2P reserves in Colombia increased 26% (by 23.0 mmboe) to 111.2 mmboe

– 2P RLI of 10.7 years

– 2P RRR of 321%

– 2P NPV10 in Colombia increased by $491 million (up 35%) to $1.9 billion

– Net 3P reserves in Colombia increased 43% (by 43.9 mmboe) to 145.6 mmboe

— Peru 3P Reserves:

– Gross 3P reserves in Peru increased 139% (by 115.3 mmbbl) to 198.3 mmbbl demonstrating the significant potential of the Situche Cntral field in the Morona block – with net 3P reserves of 131.2 mmbbl

– 3P NPV10 in Peru increased by $1.1 billion (up 145%) to $1.9 billion

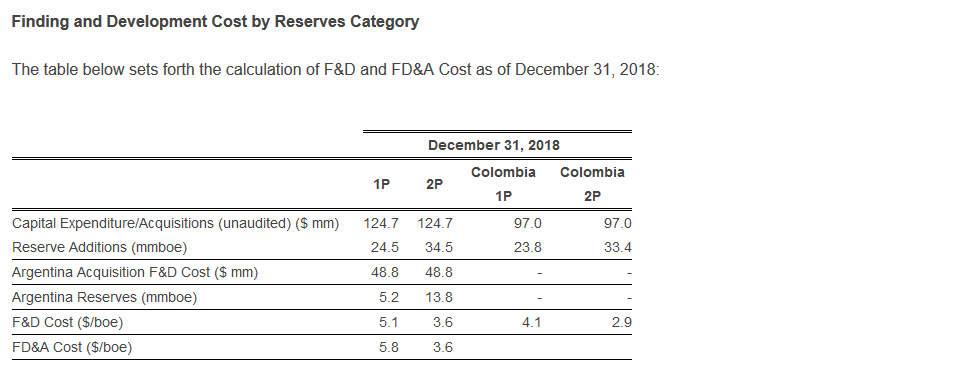

— F&D Cost:

– Finding and Development Cost (F&D Cost) for 2018 was $3.6 per boe on a 2P basis

– F&D Cost for Colombia of $2.9 per boe on a 2P basis

– Including the acquisition in Argentina, consolidated Finding, Development and Acquisition Cost (FD&A Cost) for 2018 was $3.6 per boe on a 2P basis

James F. Park, Chief Executive Officer of GeoPark, said: “Again, our team did its job. Find, prove-up, develop and produce oil and gas – safely, cleanly and economically. The reserve certification is an important independent scorecard of an upstream company’s performance – and all elements of our report show major improvements across the board through 2018. Impressive growing oil and gas reserve volumes – strong reserve replacement metrics – large asset value increases – cheap Finding and Development Cost – and big bottom-line ‘per share’ value growth. Our Colombian Llanos 34 prize keeps getting more massive with even more opportunity for expansion. Furthermore, every category of reserve was certified with significant increases – demonstrating GeoPark’s short, medium and long-term depth, stability and potential. The report also highlights GeoPark’s unique oil and gas and regional asset platform – which is made real by our relentless 16-year performance growth track record – showing our team has, can and will continue to deliver results, meet challenges, and adapt and grow to capture our abundant opportunity set. Congratulations and many thanks to the women and men of GeoPark – the most dynamic oil and gas team in Latin America today.”

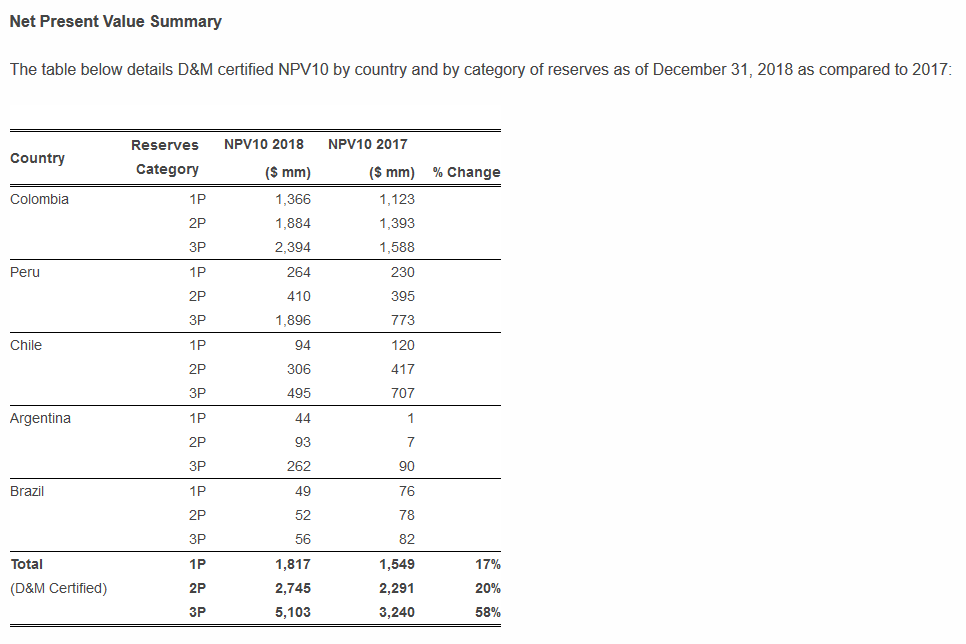

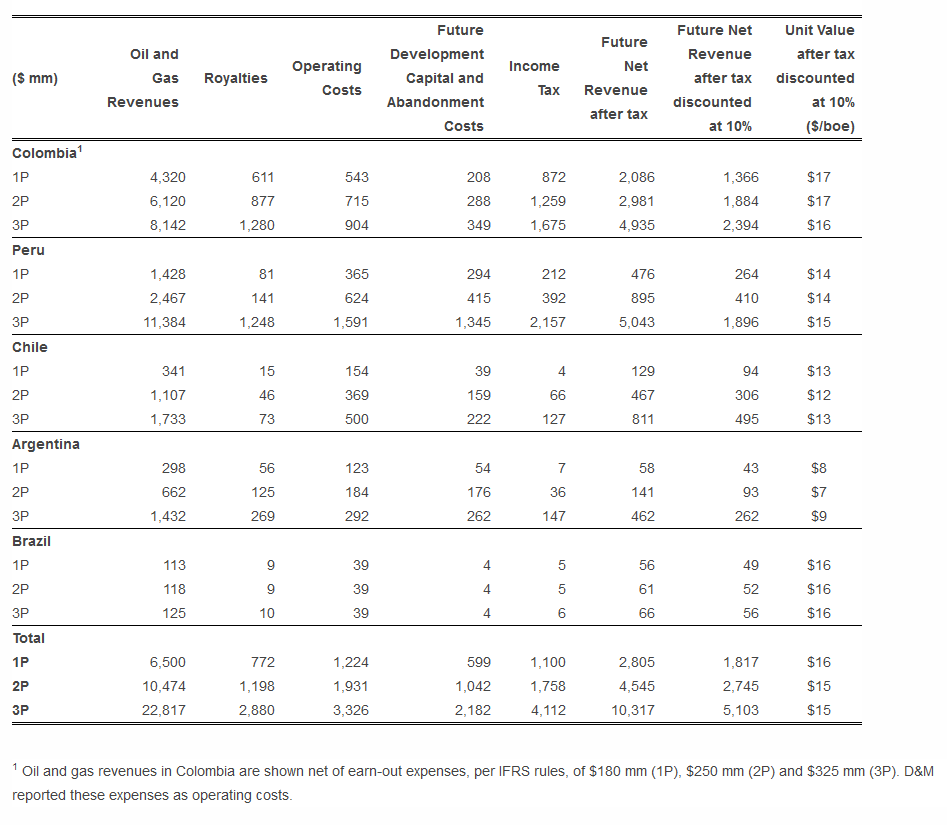

Net Present Value per Share by Country

The table below presents GeoPark’s net present value after tax and non-controlling interest, discounted at a 10% rate per share, by country, of 2P reserves as of December 31, 2018 and 2017.

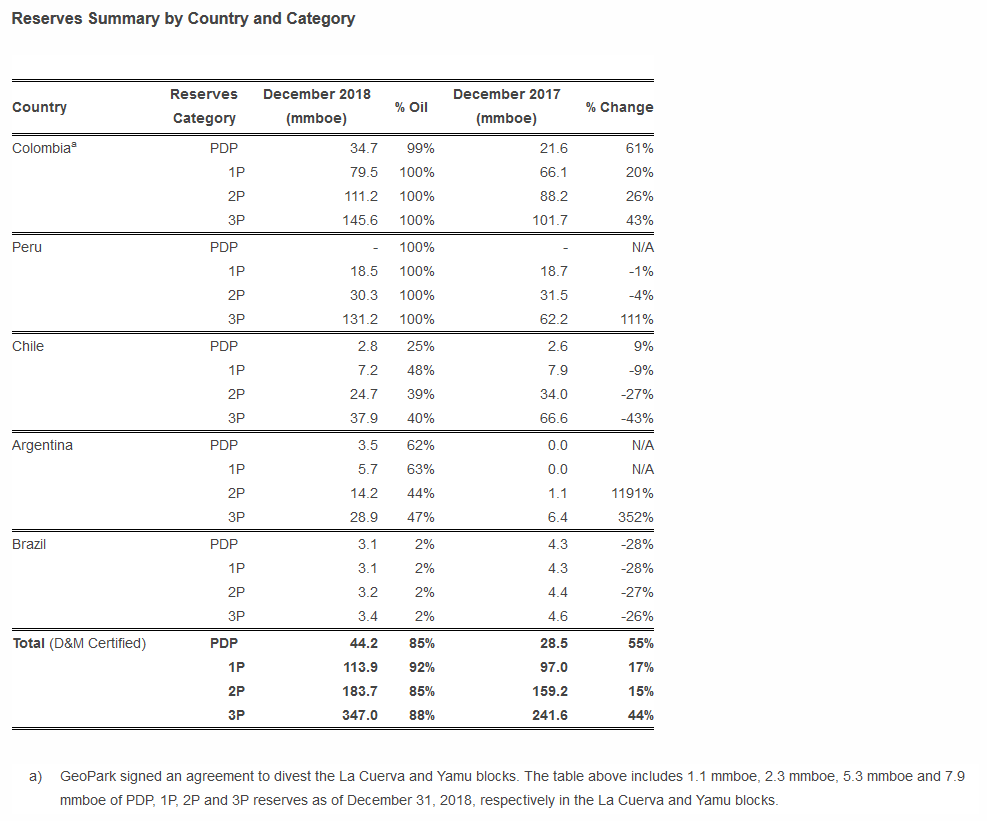

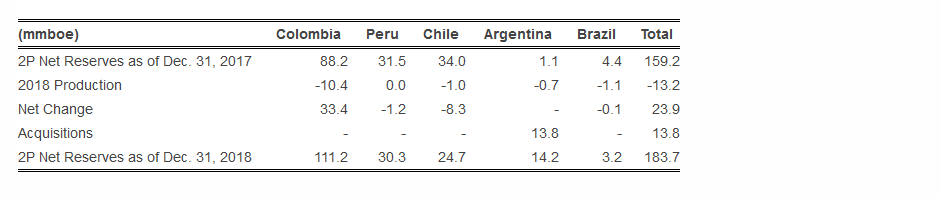

2018 Year-End Reserves Summary

GeoPark engaged D&M to carry out an independent appraisal of reserves as of December 31, 2018, covering 100% of the current assets in Colombia, Chile, Brazil, Peru and Argentina. Following oil and gas production of 13.2 mmboe in 2018, D&M certified 2P net reserves of 183.7 mmboe (85% oil and 15% gas) as of December 31, 2018. By country, the reserves were: 61% in Colombia, 17% in Peru, 13% in Chile, 7% in Argentina and 2% in Brazil.

Analysis by Business Segment

Colombia

After record production of 10.8 mmbbl in 2018 (an increase of 30% over 2017), GeoPark’s 2P D&M certified reserves increased by 26% to 111.2 mmbbl compared to 2017. Net additions of 33.4 mmbbl of 2P reserves resulted from strong reservoir performance and continued successful exploration, development and appraisal drilling in the Llanos 34 block (GeoPark operated, 45% WI).

For each barrel of oil extracted in Colombia, GeoPark added 2.3 barrels of 1P reserves, the equivalent of a 1P RRR of 229%. Similarly, for each barrel of oil extracted, GeoPark added 3.2 barrels of 2P reserves, resulting in a 2P RRR of 321%.

The 1P RLI was 7.6 years, while the 2P RLI was 10.7 years.

As of December 31, 2018, the Llanos 34 block included approximately 80-90 future development drilling locations (2P, gross, including the Mirador and Guadalupe formations). The Llanos 34 block represented 95% of GeoPark Colombia 2P D&M certified reserves as of December 31, 2018.

In November 2018, GeoPark signed an agreement with Perenco Oil and Gas to divest the La Cuerva and Yamu blocks for $18 million plus a contingent payment of $2 million based on future oil prices. GeoPark will continue operating the La Cuerva and Yamu blocks until the closing of this transaction, expected in the first months of 2019. Reserves corresponding to the La Cuerva and Yamu blocks include 2.3 mmboe of 1P (1.1 mmboe PD and 1.2 mmboe PUD), 5.3 mmboe of 2P and 7.9 mmboe of 3P reserves as of December 31, 2018.

Peru

GeoPark completed the preparation of the Environmental Impact Assessment (EIA) to initiate operations in the Situche Central oil field in the Morona block (GeoPark operated, 75% WI). The EIA was submitted to the Servicio Nacional de Certificacion Ambiental (SENACE) on July 2, 2018. The Company is currently waiting for additional comments from SENACE, which is the final step of the EIA approval process.

During 2018, D&M updated its review of the Situche Central field, including a reinterpretation of the 3D seismic, structural geology, trapping and oil migration model. Following this evaluation, D&M has certified 3P gross reserves of 198.3 mmbbl in the Situche Central field (131.2 mmbbl net to GeoPark), which represents a 111% increase with respect to the 2017 reserve certification, and provides more information with respect to the field size and significant upside potential.

The Situche Central oil field in the Morona block represented 100% of GeoPark’s Peruvian D&M certified reserves.

Chile

GeoPark’s 2P D&M certified reserves in Chile decreased by 27% to 24.7 mmboe compared to 2017. Oil and gas production, adjusted development plans and other technical revisions caused the declines, which were partially offset by drilling successes.

The 1P RLI was 7.2 years (no change from 2017). The 2P RLI decreased to 24.7 years, compared to 30.7 years in 2017.

The Fell block represented 99% of GeoPark Chile 2P D&M certified reserves and consisted of 40% oil and 60% gas, similar to 2017.

Argentina

After production of 0.7 mmboe in 2018, GeoPark’s 2P D&M certified reserves in Argentina increased significantly to 14.2 mmboe compared to 1.1 mmboe in 2017. The net increase in 2018 includes the acquisition of 100% WI and operatorship of the Aguada Baguales, El Porvenir and Puesto Touquet blocks.

The 1P RLI and 2P RLI increased to 6.1 years and 15.2 years, respectively.

The Aguada Baguales, El Porvenir and Puesto Touquet blocks represented 91% of GeoPark Argentina 2P D&M certified reserves and consisted of 42% oil and 58% gas.

Brazil

GeoPark’s 2P D&M certified reserves in Brazil decreased by 27% to 3.2 mmboe compared to 2017, resulting from production of 1.1 mmboe during 2018.

The 2P RLI decreased to 2.9 years compared to 4.0 years in 2017.

The Manati field (GeoPark non-operated, 10% WI) represented 100% of GeoPark’s Brazilian D&M certified reserves and is 98% gas.

D&M Net Certified Reserves Change by Country

The following table shows the net change in 2P net reserves by country from December 31, 2017 to December 31, 2018:

***