(Petrobras, 20.Dec.2018) — Petrobras announced early results of its previously announced debt tender offers. As of 5:00 p.m., New York City time, on December 19, 2018 (the “Early Tender Deadline”) holders of: (i) US$1,065,376,000 principal amount of the outstanding notes of the series set forth in the table below under the heading “Tender Group 1” (the “Tender Group 1 Notes”) and (ii) US$107,621,000 and £31,012,000 principal amount of the outstanding notes of the series set forth in the table below under the heading “Tender Group 2” (the “Tender Group 2 Notes” and, together with the Tender Group 1 Notes, the “Notes” and each a “series” of Notes), issued by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”), tendered their Notes, pursuant to PGF’s previously announced cash tender offers (the “Tender Offers”).

The total consideration payable for each series of Notes was determined by PGF, in part, pursuant to a modified “Dutch auction” as described in the offer to purchase dated December 6, 2018 (the “Offer to Purchase”). The clearing premium determined by PGF for the Tender Group 1 Notes is US$30.00 (the “Tender Group 1 Clearing Premium”), and the clearing premium determined by PGF for the Tender Group 2 Notes is US$37.50 (the “Tender Group 2 Clearing Premium”).

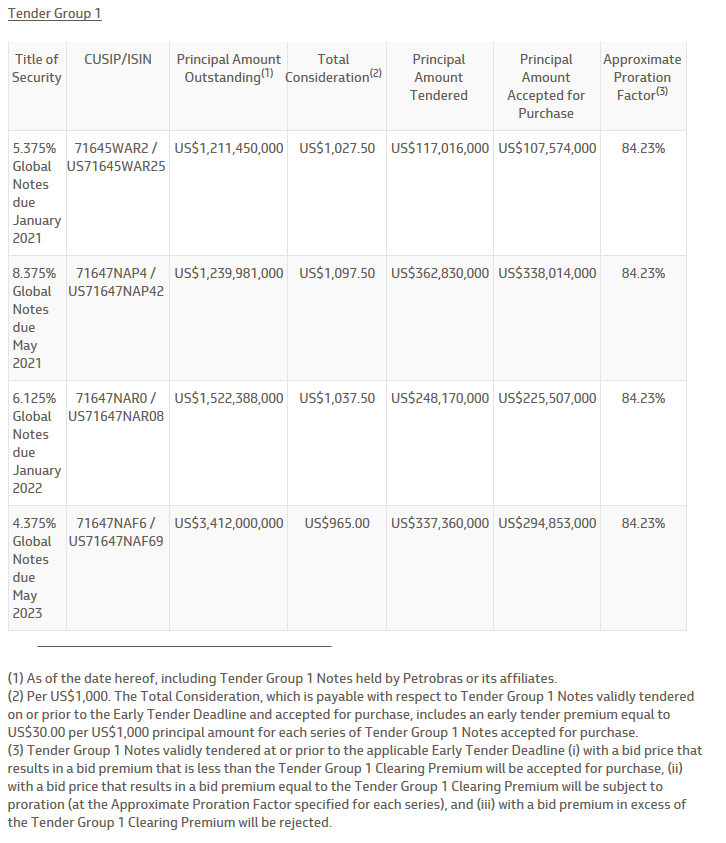

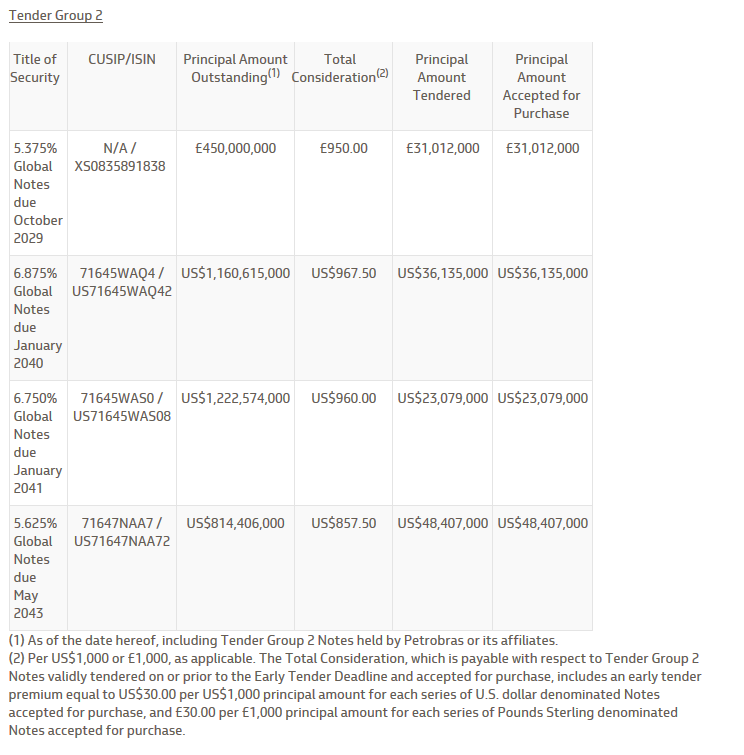

The following tables summarize the early tender results as of the Early Tender Deadline, the principal amount of Notes that PGF has accepted for purchase and the approximate proration factor for each series of Notes:

Because the purchase of Tender Group 1 Notes validly tendered in the Tender Offers would cause PGF to purchase an aggregate principal amount of Tender Group 1 Notes that would result in an aggregate amount to be received by holders of Tender Group 1 Notes in excess of US$1.0 billion, PGF has accepted for purchase only US$107,574,000 principal amount of 5.375% Global Notes due 2021, US$338,014,000 principal amount of 8.375% Global Notes due 2021, US$225,507,000 principal amount of 6.125% Global Notes due 2022 and US$294,853,000 principal amount of 4.375% Global Notes due 2023. Tender Group 1 Notes validly tendered at or prior to the applicable Early Tender Deadline (i) with a bid price that results in a bid premium that is less than the Tender Group 1 Clearing Premium will be accepted for purchase, (ii) with a bid price that results in a bid premium equal to the Tender Group 1 Clearing Premium will be subject to proration (at the Approximate Proration Factor specified for each series), and (iii) with a bid premium in excess of the Tender Group 1 Clearing Premium will be rejected.

Because the Tender Offers for Tender Group 1 Notes were oversubscribed at the Early Tender Deadline, holders of Tender Group 1 Notes who tender after the Early Tender Deadline will not have any of their Tender Group 1 Notes accepted for purchase. Any tendered Tender Group 1 Notes that are not accepted for purchase will be returned or credited without expense to the holder’s account.

The total cash payment to purchase on the Early Settlement Date the accepted Tender Group 1 Notes will be approximately US$999.9 million excluding accrued and unpaid interest. Tender Group 1 Notes that have been validly tendered on or prior to the Early Tender Deadline cannot be withdrawn, except as may be required by applicable law.

PGF has accepted for purchase all Tender Group 2 Notes validly tendered in the Tender Offers on or prior to the Early Tender Deadline. Holders of Tender Group 2 Notes that validly tendered on or prior to the Early Tender Date and whose Tender Group 2 Notes have been accepted for purchase are entitled to receive the total consideration set forth in the table above under the heading “Tender Group 2,” which includes an early tender premium, and to receive accrued and unpaid interest. Holders of Tender Group 2 Notes that are validly tendered after the Early Tender Date but on or before the Expiration Time and whose Tender Group 2 Notes are accepted for purchase will receive only the applicable tender offer consideration, which is equal to the total consideration set forth in the table above under the heading “Tender Group 2,” minus the applicable early tender premium, and to receive accrued and unpaid interest.

Tender Group 2 Notes tendered on or prior to the Early Tender Deadline, which have been accepted for purchase on the Early Settlement Date (as defined below), will have priority over Tender Group 2 Notes tendered after the Early Tender Deadline. If the Tender Offers for Tender Group 2 Notes are oversubscribed at the Expiration Date, then only a portion of Tender Group 2 Notes tendered after the Early Tender Deadline may be accepted for purchase pursuant to the proration procedures described in the Offer to Purchase.

The total cash payment to purchase on the Early Settlement Date the accepted Tender Group 2 Notes will be approximately US$ $135.9 million based on the U.S. dollar exchange rate described herein, excluding accrued and unpaid interest. Tender Group 2 Notes that have been validly tendered on or prior to the Early Tender Deadline cannot be withdrawn, except as may be required by applicable law.

The early settlement date on which PGF will make payment for Notes accepted in the Tender Offers is expected to be December 21, 2018 (the “Early Settlement Date”). The Tender Offers will expire at 11:59 p.m., New York City time, on January 4, 2019 (the “Expiration Time”).

The exchange rate used to translate Pounds Sterling to U.S. dollars was US$1.2659 per Pound Sterling, the applicable exchange rate as of 2:00 p.m., New York City time on December 19, 2018, as reported on Bloomberg screen page “FXIP” under the heading “FX Rate vs. USD.”

The Tender Offers are being made pursuant to the Offer to Purchase, and the related letter of transmittal dated December 6, 2018 (as amended or supplemented from time to time, the “Letter of Transmittal”), which set forth in more detail the terms and conditions of the Tender Offers.

PGF has engaged BB Securities Limited, Credit Agricole Securities (USA) Inc., Itau BBA USA Securities, Inc., J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Mizuho Securities USA LLC to act as dealer managers (the “Dealer Managers”) in connection with the Tender Offers. Global Bondholder Services Corporation is acting as the depositary and information agent for the Tender Offers.

***