(Enel Generación Chile, 19.Dec.2018) — ENEL GENERACIÓN CHILE S.A. announced that its Board of Directors has unanimously approved the voluntary delisting of its American Depositary Shares (ADSs) from The New York Stock Exchange (the NYSE). In connection with its intended delisting, Enel Generación Chile notified the NYSE today that it will apply for voluntary delisting of its ADSs and has requested that the ADSs be suspended from trading on December 31, 2018. As a result, the last day of trading for the ADSs on the NYSE is expected to be on December 28, 2018.

-

Reasons for the Application for Voluntary Delisting of ADSs from the NYSE

Following the corporate reorganization transaction by its parent company, Enel Chile S.A., in 2018, Enel Chile now owns 93.6% of Enel Generación Chile’s shares of common stock and Enel Generación Chile ADSs currently comprise only approximately 0.64% of the total outstanding shares of common stock. Enel Generación Chile believes that the costs associated with continuing the listing of its ADSs on the NYSE exceed the benefits received by the company, as the primary market for the shares of Enel Generación Chile not owned by Enel Chile is now the Santiago Stock Exchange. As a result, Enel Generación Chile has decided to file an application for voluntary delisting from the NYSE as part of its effort to reduce operational expenses.

-

Stock Exchanges on Which Enel Generación Chile will Maintain its Listings

Enel Generación Chile will maintain its listings on the Santiago Stock Exchange and the Chile Electronic Stock Exchange. Enel Generación Chile has not otherwise arranged for the listing of the ADSs or shares of its common stock on another national securities exchange in the United States. After the delisting of its ADSs from the NYSE, Enel Generación Chile currently intends to maintain its American Depositary Receipt (ADR) Program in the United States and, therefore, anticipates that its ADSs will continue to be traded in the United States on the over-the-counter market. However, there can be no assurance that such an over-the-counter market in the ADSs will develop.

-

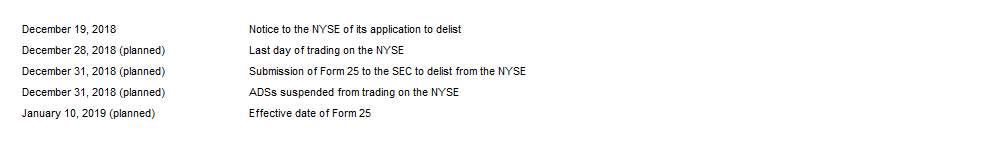

Implementation Schedule of Application for Voluntary Delisting of ADRs from the NYSE*

* The schedule provided above, including the anticipated effective dates, may be delayed if the SEC objects to the delisting or requests an extended review or for other reasons.

-

Additional Information for ADR Holders

Following delisting of the ADSs from the NYSE, Enel Generación Chile currently intends to maintain its ADR Program. This will enable investors to retain their ADSs and facilitate trading on the U.S. over-the-counter market for the time being. The depositary of Enel Generación Chile’s ADR Program will remain Citibank, N.A.

For inquiries regarding Enel Generación Chile’s ADSs and ADR Program, please contact:

Citibank, N.A. Shareholder ServicesTel: USA +1-877-248-4237] (toll free)

International: +1-781-575-4555

Website: www.citi.com/dr

E-mail: citibank@shareholders-online.com

Shareholder Services representatives are available Monday through Friday from 8:30 a.m. to 6:00 p.m. Eastern time in the U.S.

-

Future Actions

Enel Generación Chile’s reporting obligations under applicable U.S. federal securities laws are expected to continue after the delisting from the NYSE. Following satisfaction of the relevant deregistration conditions under the applicable U.S. federal securities laws, Enel Generación Chile intends to terminate its reporting obligations under the applicable U.S. federal securities laws and to deregister all classes of its registered securities. Enel Generación Chile intends to release further information on such deregistration and termination of reporting obligations at a later date.

Enel Generación Chile reserves the right, for any reason, to delay any of the filings described above, to withdraw them prior to effectiveness, and to otherwise change its plans in respect of delisting, continuation of the ADR Program or deregistration and termination of its reporting obligations under applicable U.S. federal securities laws in any way.

***